Comprehensive Guide On Understanding Income Tax Notices

A. Income Tax Notice:

An income tax notice is a formal notification issued by the Income Tax Department to an individual or entity responsible for paying taxes. This communication can arise for several reasons, including the failure to file an income tax return, discrepancies between the declared and paid taxes, delays in tax payments, or omissions in reporting income from various sources. Generally, the notice details the specific concern and may require the taxpayer to provide additional documentation, clarification, or to settle any outstanding tax obligations.

B. Role Of Income Tax Notice:

Such notices play a crucial role in ensuring compliance with tax regulations and maintaining accurate records. They serve not only as a reminder of the taxpayer’s responsibilities but also as a means for the tax authorities to address any inconsistencies or issues that may arise during the assessment process. By clearly outlining the nature of the problem, the notice facilitates a transparent dialogue between the taxpayer and the Income Tax Department, allowing for the resolution of any misunderstandings or errors in a timely manner.

C. Ways Of Receiving Notice:

At present, you can receive your income tax notice as an email attachment sent to the email address you have registered on the e-filing website. Additionally, you have the option to log into your account on the official e-filing portal. By navigating to the “Pending Actions” section, you can easily view or download any notices that may require your prompt attention.

D. Reasons Of Income Tax Notice Arrival:

There are several reasons that may lead to the issuance of an Income Tax Notice. One common cause is discrepancies, which occur when there are inconsistencies between the information you provided in your Income Tax Return (ITR) and the data the department has on record, particularly as reflected in Form 26AS. Another frequent reason is filing errors, such as submitting the incorrect ITR form. Additionally, if you fail to meet the filing deadline, you will receive a notice regarding your late submission.

Notices can also arise from issues related to tax payments, such as overpayment or underpayment of due taxes, which may include a notification about a refund or a tax demand from the authorities. Furthermore, if you neglect to report high-value transactions, like cash deposits exceeding 2 lakh in your bank account during the fiscal year, a notice will be issued. Lastly, your ITR may be selected for random scrutiny by the Income Tax Department, resulting in a notice informing you of this review.

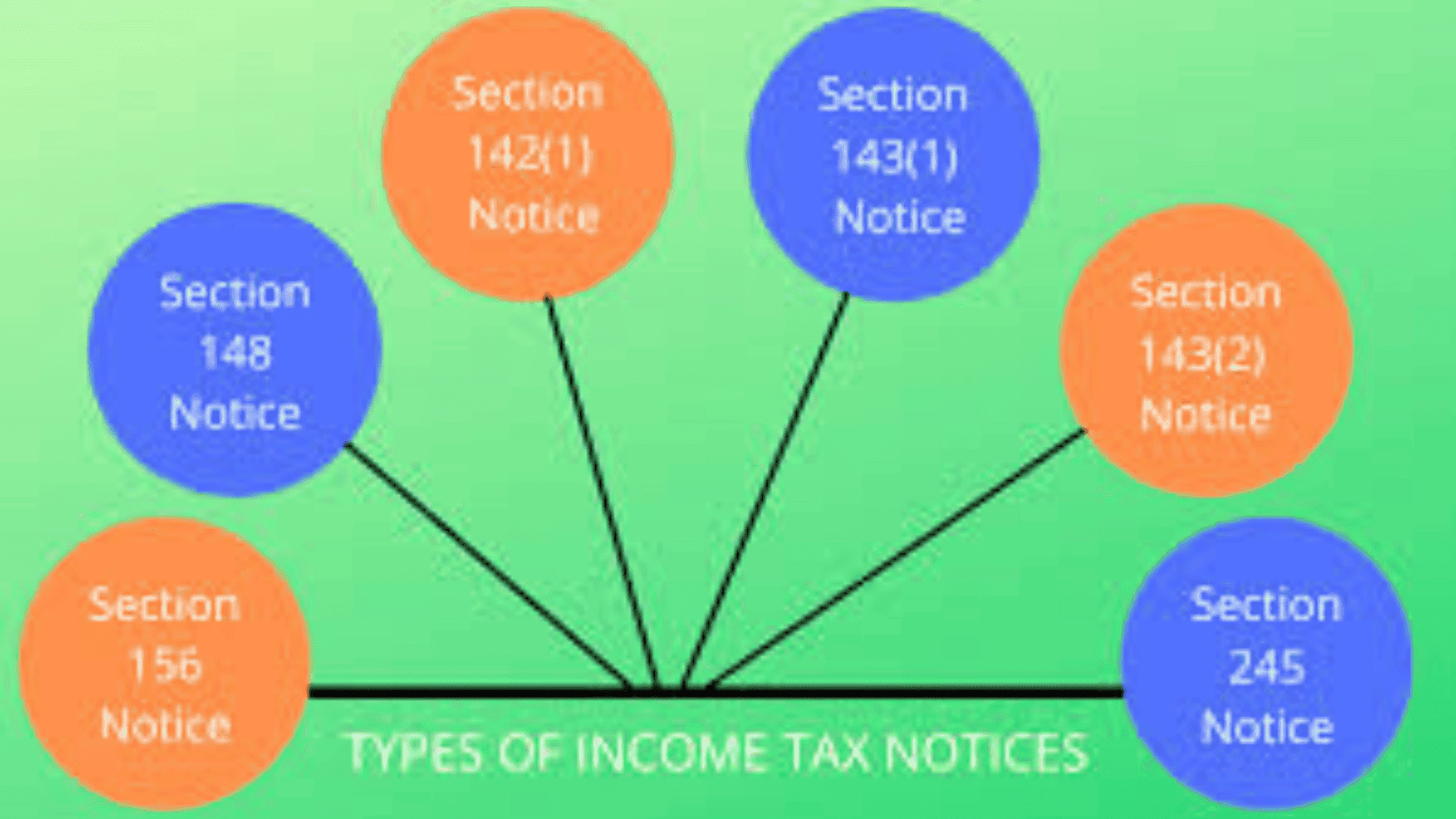

E. Types of Income Tax Notice:

The Income Tax Act of 1961 outlines a range of provisions governing the issuance of various types of income tax notices. Here are the essential ones that taxpayers should be aware of:

1. Intimation Under Section 143(1)

2. Notice Under Section 143(2) and Section 143(3)

3. Demand Notices Under Section 156

4. Notice Under Section 142 (1)

5. Notice Under Section 139(9)

6. Tax Notice Under Section 148

7. Summons Notice Under Section 131

8. Intimation Under Section 245

While there is no rule against responding to an income tax notice on your own, it might be advisable to seek expert help from a tax expert or chartered accountant. This can help ensure that your response is appropriate and you are aware of the correct course of action to resolve the issue at hand.

1. Intimation Under Section 143(1)

This notice, commonly issued by the IT department, is known as an “Intimation u/s 143(1).” It serves as a preliminary communication following the processing of your tax returns. The implications of this notice can vary, and it may indicate one of several scenarios.

Firstly, it could mean that your tax calculations align perfectly with those of the department, in which case no further action is necessary on your part. Alternatively, if you have overpaid your taxes for the fiscal year, the excess amount will be refunded to you, potentially with interest, through the established income tax refund process. Lastly, the notice may also inform you that you have underpaid your taxes according to the tax authorities’ assessment, necessitating the payment of the outstanding amount along with any applicable penal interest, which can be settled using the designated Income Tax Challan.

2. Notice Under Section 143(2) and Section 143(3)

These two types of notice are closely related. An income tax notice u/s 143(2) is issued by tax authorities as part of the scrutiny assessment process u/s 143 (3). This type of scrutiny assessment may be undertaken by the assessing officer in order to ensure that the taxpayer has not understated income, paid lower tax or shown excessive loss to reduce tax liability. While you do not need to take action on receiving such a notice, if closer scrutiny reveals discrepancies you might receive another income tax notice u/s 156 subsequent to the scrutiny assessment.

3. Demand Notices Under Section 156

Notices issued under section 156 or its various subsections generally serve as formal requests for the payment of outstanding taxes. When you have unpaid tax obligations, the Income Tax Department will issue a notice detailing the specific amount you owe and the deadline for settling this payment. These notices often include additional penalties and interest charges, which are explicitly outlined within the document. If you find yourself in receipt of such a notice, it is wise to consult with a tax professional or chartered accountant to determine the best course of action moving forward.

Receiving a notice under this section can be a concerning experience, as it indicates that your tax liabilities require immediate attention. The Income Tax Department’s communication will not only highlight the total amount due but also emphasize the importance of adhering to the specified payment timeline to avoid further complications. Given the potential for accruing fines and interest, seeking guidance from a qualified tax expert can provide clarity and help you navigate the necessary steps to resolve the issue effectively.

4. Notice Under Section 142(1)

A notice regarding income tax may be generated following the submission of your income tax returns when the Assessing Officer (AO) requires further clarification or supplementary documentation concerning your filed Income Tax Return (ITR). This request for additional information can encompass various documents, such as a detailed statement of assets and liabilities, as well as supporting accounts or documents that validate claims related to income or tax-saving investments. Furthermore, a tax notice under Section 142(1) may also be issued in instances where the returns have been filed after the designated deadline, commonly referred to as belated returns.

In such cases, the AO’s inquiry aims to ensure compliance with tax regulations and to verify the accuracy of the information provided in the ITR. The necessity for additional documentation underscores the importance of maintaining thorough records and being prepared to substantiate any claims made in the tax return. Taxpayers should be aware that responding promptly and accurately to such notices is crucial, as it can significantly impact the resolution of their tax obligations and any potential penalties associated with late filings or discrepancies in reported income.

5. Notice Under Section 139(9)

A tax notice issued under Section 139(9) is commonly known as a ‘defective return’ notice. This type of notice is generated by the Income Tax department when discrepancies or omissions are identified in an individual’s tax return. Such discrepancies may include failure to declare certain income, inaccuracies in personal details, the use of an inappropriate Income Tax Return (ITR) form, or inconsistencies between the Tax Deducted at Source (TDS) and the tax amount paid.

Upon receiving a notice under Section 139(9), it is essential to act promptly, as there is typically a designated timeframe of 15 days within which the taxpayer must respond. This response may involve submitting a revised tax return to rectify the identified issues. Adhering to this timeline is crucial to avoid potential penalties or further complications with the tax authorities.

6. Notice Under Section 148

An income tax notice under section 148 is issued concerning income tax returns that were submitted in the past. The Income Tax Department may issue this notice if the assessing officer suspects that certain income has not been accounted for in a previously submitted tax return. In this scenario, you may be required to provide detailed information about your income for a particular financial year, along with any relevant supporting documents, such as evidence of tax-saving investments made during that time frame.

When you receive such a notice, it is essential to respond promptly and accurately, as failure to do so could lead to further scrutiny or penalties. The request for additional information typically aims to clarify discrepancies or omissions in your earlier filings. Therefore, gathering all necessary documentation, including bank statements, investment certificates, and any other pertinent records, will be crucial in addressing the notice effectively and ensuring compliance with tax regulations.

7. Summons Notice Under Section 131

If you receive an income tax notice under Section 131 or its sub-sections such as 131 (1A), it means that you have been summoned in-person by tax authorities. Common reasons for issuing such a summons include:

- For conducting inquiry by the IT Department for discovery, inspection and/or verification of different documents or people

- In order to ensure attendance of a person for examination under oath

- To demand the production of key documents such as book of accounts, Form 16, home loan amortisation schedule, etc. from the assessee

It is mandatory to respond to such as summons request as non-compliance might lead to legal action from the tax authorities along with potentially hefty fines.

8. Intimation Under Section 245

This notification has been issued by the IT department to request confirmation from the taxpayer regarding the possibility of offsetting any outstanding tax liabilities from previous financial years with the income tax refund granted in the current assessment year. Upon receiving an income tax notice under section 245, the taxpayer has the option to either agree or disagree with the proposed adjustments, which may include taking corrective measures such as submitting a revised return within a 30-day timeframe. Should the taxpayer fail to respond within this designated period, the tax authorities will proceed to automatically finalize the adjustments and will subsequently issue the remaining refund amount.