Income Tax Returns EFiling- Who Is Responsible For EFiling?

A. Is CA Responsible For ITR Filing?

Filing Income Tax Returns (ITRs) is a crucial obligation for all taxpayers, yet there exists a prevalent misunderstanding that this duty rests solely with Chartered Accountants (CAs). In truth, the responsibility for ITR filing is a collaborative effort that involves both the taxpayer and the CA. Taxpayers must provide accurate financial information and ensure that they meet deadlines, while CAs offer their expertise in navigating the complexities of tax regulations and ensuring compliance. This article seeks to dispel the myth surrounding the exclusive role of CAs in the ITR filing process and to elucidate the distinct yet interconnected responsibilities of both parties. Recognizing the importance of this partnership is vital for achieving a seamless and efficient tax-filing experience, ultimately leading to accurate submissions and adherence to legal requirements.

B. Understanding the ITR Filing Process

The process of filing your Income Tax Return (ITR) requires a thorough evaluation of your earnings and tax obligations for a given financial year, which you must then report to the relevant tax authorities. This entails gathering and submitting precise information about your various income sources, any deductions or exemptions you may qualify for, and the tax payments you have made throughout the year. Regardless of whether you are employed, run your own business, or work as a freelancer, it is essential to complete your ITR filing on an annual basis to ensure compliance with tax regulations and to avoid any potential penalties.

C. Misconception: Only CAs File ITRs

A common misunderstanding is that the responsibility for filing Income Tax Returns (ITRs) rests solely with Chartered Accountants (CAs). While CAs can provide valuable assistance and expertise throughout the filing process, the ultimate obligation to ensure accurate and timely submission of tax returns lies with the taxpayer themselves. It is essential for individuals, businesses, and various entities to take an active role in evaluating their financial situations, gathering necessary documentation, and supplying precise information for their tax filings. This proactive engagement not only helps in compliance with tax regulations but also minimizes the risk of errors that could lead to penalties or audits. Therefore, taxpayers should not rely exclusively on CAs but should instead understand their own financial circumstances and responsibilities in the tax filing process.

D. Roles and Responsibilities of Taxpayers – CA For ITR Filing

1. Maintaining Accurate Financial Records

Keeping precise financial records is essential for effective financial management and serves as the bedrock for responsible fiscal practices. Taxpayers are required to diligently document all financial transactions and activities throughout the year, ensuring that no detail is overlooked. This comprehensive record-keeping should encompass income from various avenues, including salaries, business revenues, investment returns, and any other sources of earnings. Furthermore, it is equally important to maintain a thorough account of expenses incurred, investments made, deductions claimed, and tax payments processed. Such meticulous documentation not only aids in personal financial oversight but also prepares individuals for the complexities of tax season.

The significance of accurate financial records cannot be overstated, as they play a pivotal role in the preparation and submission of a precise Income Tax Return (ITR). When taxpayers have well-organized records, they can easily compile the necessary information required for their tax filings, minimizing the risk of errors and potential audits. Additionally, these records provide a clear picture of one’s financial health, enabling better decision-making regarding future investments and expenditures. By prioritizing the maintenance of detailed financial documentation, individuals can navigate their financial responsibilities with confidence and ensure compliance with tax regulations, ultimately fostering a more secure financial future.

2. Understanding Tax Laws and Regulations

Understanding the tax laws and regulations pertinent to your financial circumstances is vital for ensuring accurate and compliant tax filing. Given the complexity and frequent changes in tax legislation, it is essential for taxpayers to remain informed and up-to-date. This knowledge not only aids in adhering to relevant tax laws but also enables individuals to claim appropriate deductions and report their income correctly. Ultimately, being well-versed in tax regulations empowers taxpayers to meet their obligations and mitigate the risk of legal issues stemming from non-compliance.

3. Filing ITR Timely and Accurately

t is essential for taxpayers to file their Income Tax Returns (ITR) accurately and within the designated deadlines. This responsibility not only ensures compliance with existing tax laws but also fulfills the legal obligation of reporting income and taxes to the relevant authorities. By adhering to the specified timelines, taxpayers can avoid potential penalties and legal issues that may arise from late or incorrect submissions. Accurate filing reflects a commitment to transparency and accountability, which are fundamental principles of the tax system.

The consequences of failing to file an ITR on time or providing incorrect information can be significant, leading to financial penalties and complications that may require legal intervention. Therefore, it is crucial for individuals and businesses alike to pay close attention to the details when preparing their tax returns. This includes gathering all necessary documentation, double-checking figures, and ensuring that all income sources are reported accurately. By prioritizing timely and precise filing, taxpayers can not only meet their legal obligations but also contribute to a more efficient and effective tax system.

4. Choosing the Appropriate ITR Form

Taxpayers need to exercise caution when selecting the appropriate Income Tax Return (ITR) form, as this choice is heavily influenced by their specific income sources and overall financial circumstances. The Income Tax Department offers a range of ITR forms designed to accommodate various taxpayer categories, each with distinct income types. It is essential for individuals to thoroughly review the instructions and requirements associated with each form, as this ensures that they report their financial information accurately. The correct form not only facilitates proper documentation but also aligns with the taxpayer’s unique situation, which is vital for compliance with tax regulations.

Choosing the wrong ITR form can have serious repercussions, including inconsistencies in reported income, deductions, and overall tax liability. Such discrepancies may lead to complications that could escalate into legal challenges or penalties from tax authorities. Therefore, taxpayers must take the time to understand their financial profiles and the implications of their choices regarding ITR forms. By doing so, they can mitigate the risk of errors and ensure a smoother filing process, ultimately safeguarding themselves against potential audits or disputes with the tax department.

E. Roles and Responsibilities of Chartered Accountants – CA For ITR Filing

1. Guidance and Assistance:

Certified Accountants (CAs) play a crucial role in assisting taxpayers by offering expert guidance on the complexities of tax legislation. They help individuals and businesses comprehend the intricacies of tax laws, ensuring that clients are well-informed about their rights and obligations. Additionally, CAs are instrumental in the preparation of financial statements, which are essential for accurate tax reporting and compliance. Their expertise extends to navigating the Income Tax Return (ITR) filing process, where they provide valuable support in organizing necessary documentation, optimizing tax deductions, and ensuring timely submissions. This comprehensive assistance not only alleviates the stress associated with tax matters but also enhances the overall financial health of their clients.

2. Ensuring Compliance:

Chartered Accountants (CAs) play a crucial role in the preparation of Income Tax Returns (ITR), ensuring that all submissions adhere to the relevant tax laws and regulations. Their expertise not only guarantees compliance with legal requirements but also allows for the strategic optimization of tax liabilities. By leveraging their knowledge of the tax code, CAs can identify deductions, credits, and other opportunities that may reduce the overall tax burden for individuals and businesses alike. This dual focus on compliance and tax efficiency is essential for navigating the complexities of the tax system, ultimately providing clients with peace of mind and financial benefits.

3. Reviewing and Submitting ITR

Chartered Accountants (CAs) play a crucial role in the tax filing process by meticulously reviewing the Income Tax Return (ITR) prior to its submission. This review involves a thorough examination to ensure that all information is accurate and complete, thereby minimizing the risk of errors that could lead to complications with tax authorities. Once the review is finalized, CAs manage the entire submission process, ensuring that all necessary documentation is filed correctly and on time. Additionally, they serve as the primary point of contact for any communications with tax authorities, addressing queries and providing clarifications as needed, which helps to streamline the process and alleviate any potential concerns for their clients.

F. Importance of Accurate Information to the CA

When a taxpayer engages a Chartered Accountant (CA) for the purpose of filing their Income Tax Return (ITR), it is crucial to provide thorough and precise information. The integrity of the ITR submission is fundamentally dependent on the quality of the data shared with the CA. Any inaccuracies or omissions in the information can result in significant errors within the ITR, which may not only lead to financial penalties but also create unnecessary legal complications. Therefore, ensuring that all details are complete and accurate is essential for a smooth filing process and to avoid potential repercussions that could arise from misrepresentation or incomplete disclosures.

G. Conclusion – CA For ITR Filing

In summary, the responsibility of filing Income Tax Returns (ITR) lies jointly with the taxpayer and the Chartered Accountant (CA). While CAs bring essential expertise and support to the process, it is ultimately the taxpayer who must ensure that their ITR is filed accurately and on time. A clear understanding of the distinct roles and responsibilities of both parties is vital for a smooth tax-filing experience. Although enlisting the help of a CA can greatly enhance the process, the taxpayer’s commitment to providing precise information and engaging actively is indispensable for achieving compliance and accuracy in their ITR submissions.

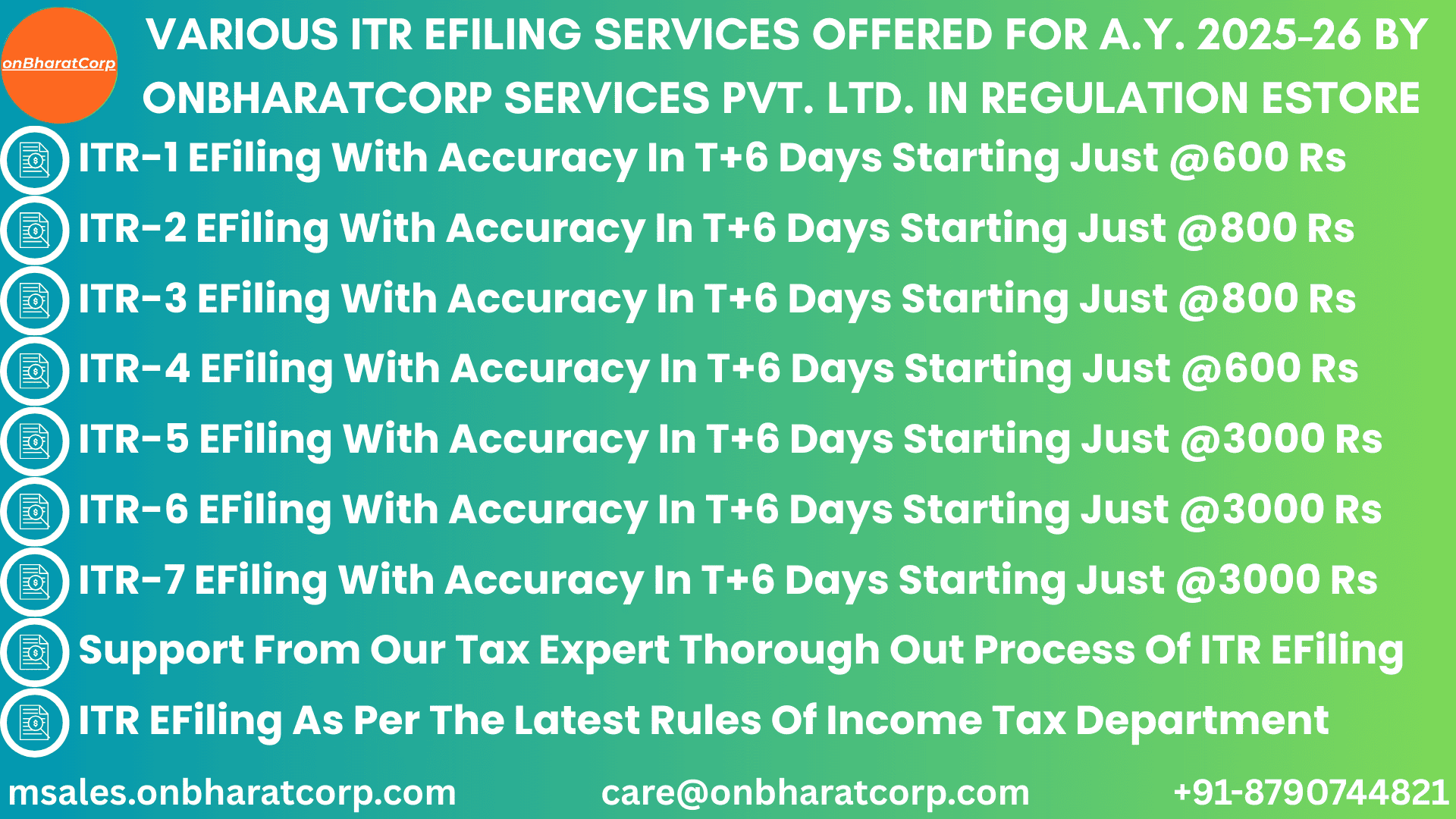

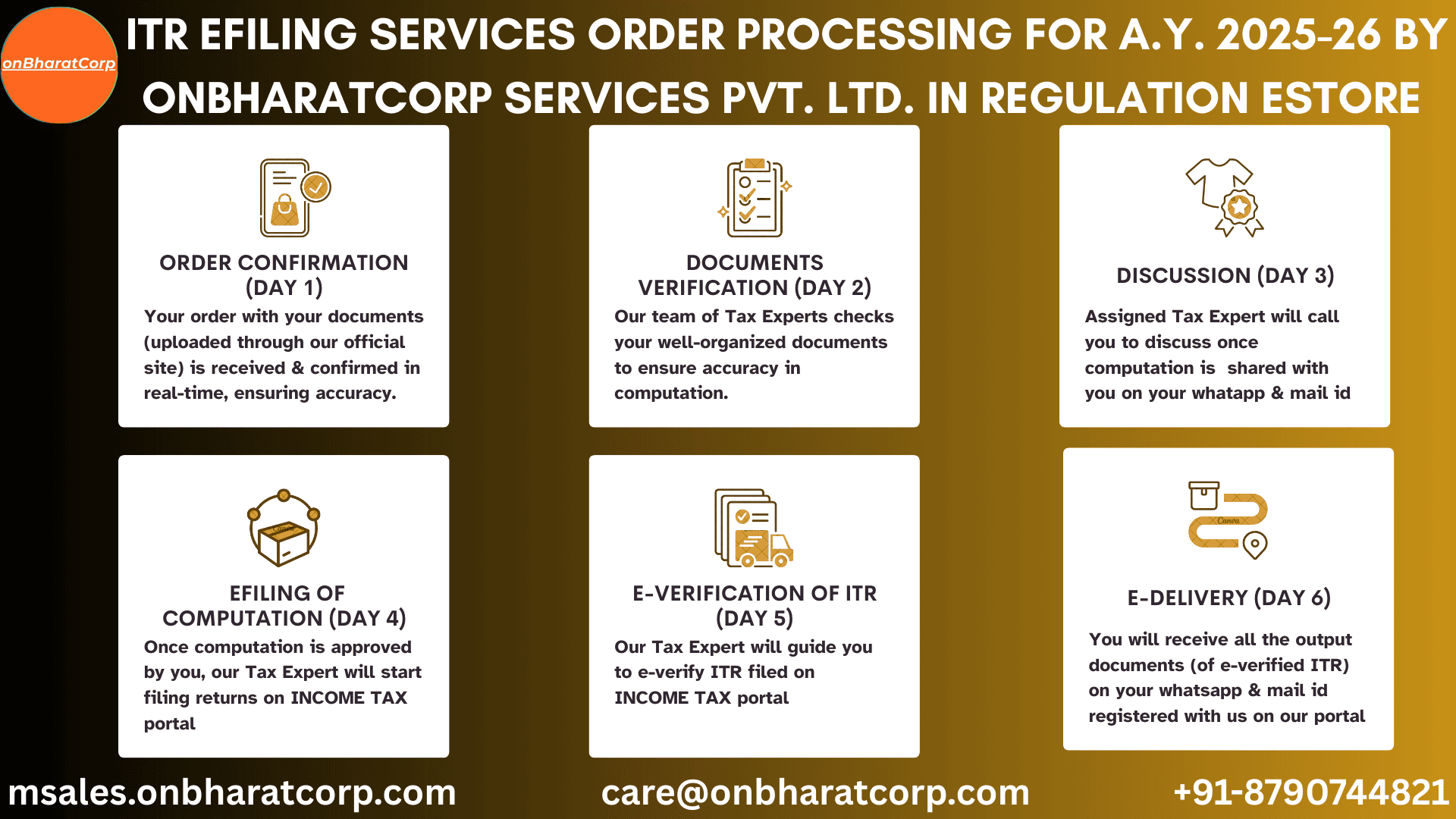

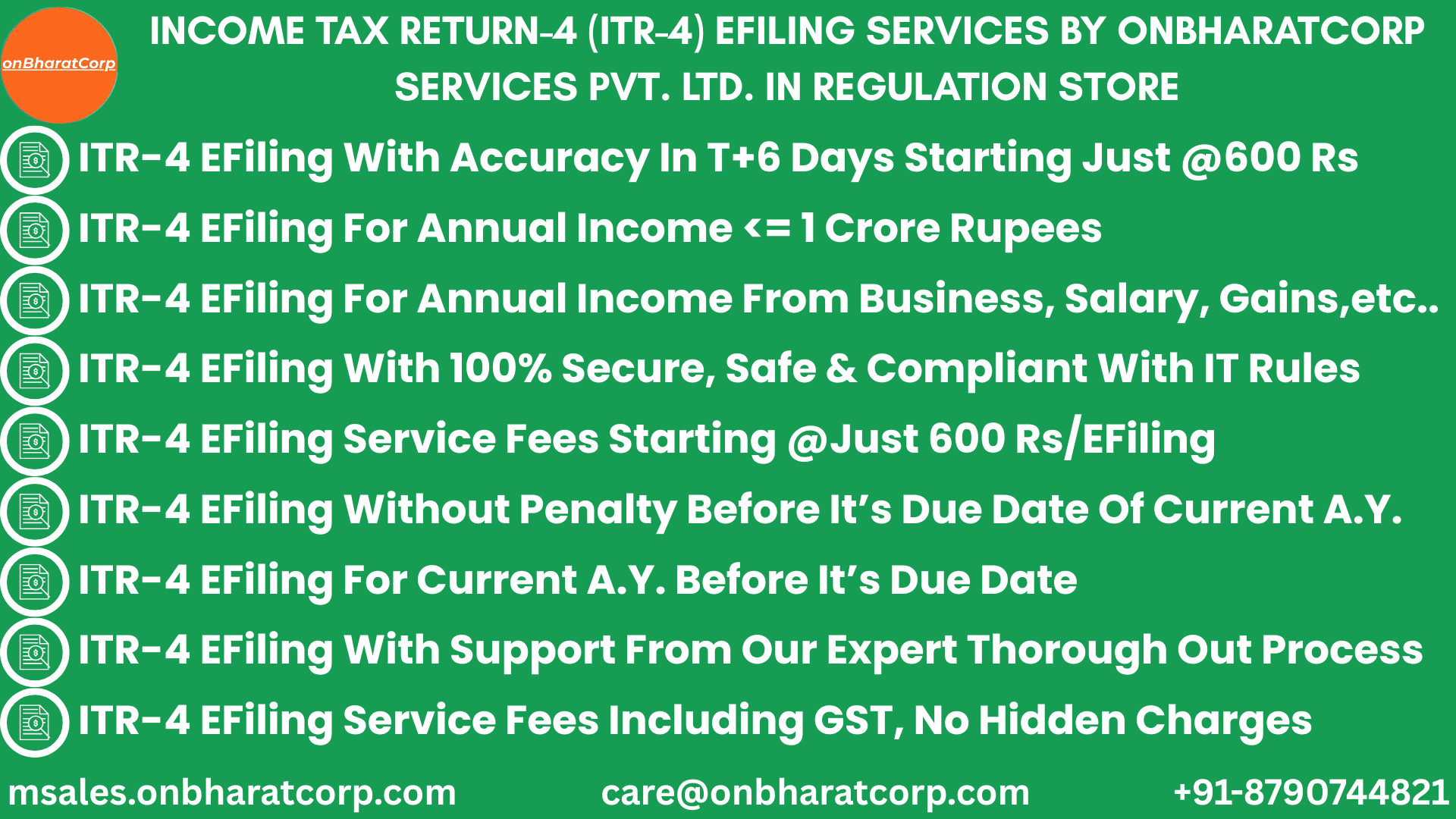

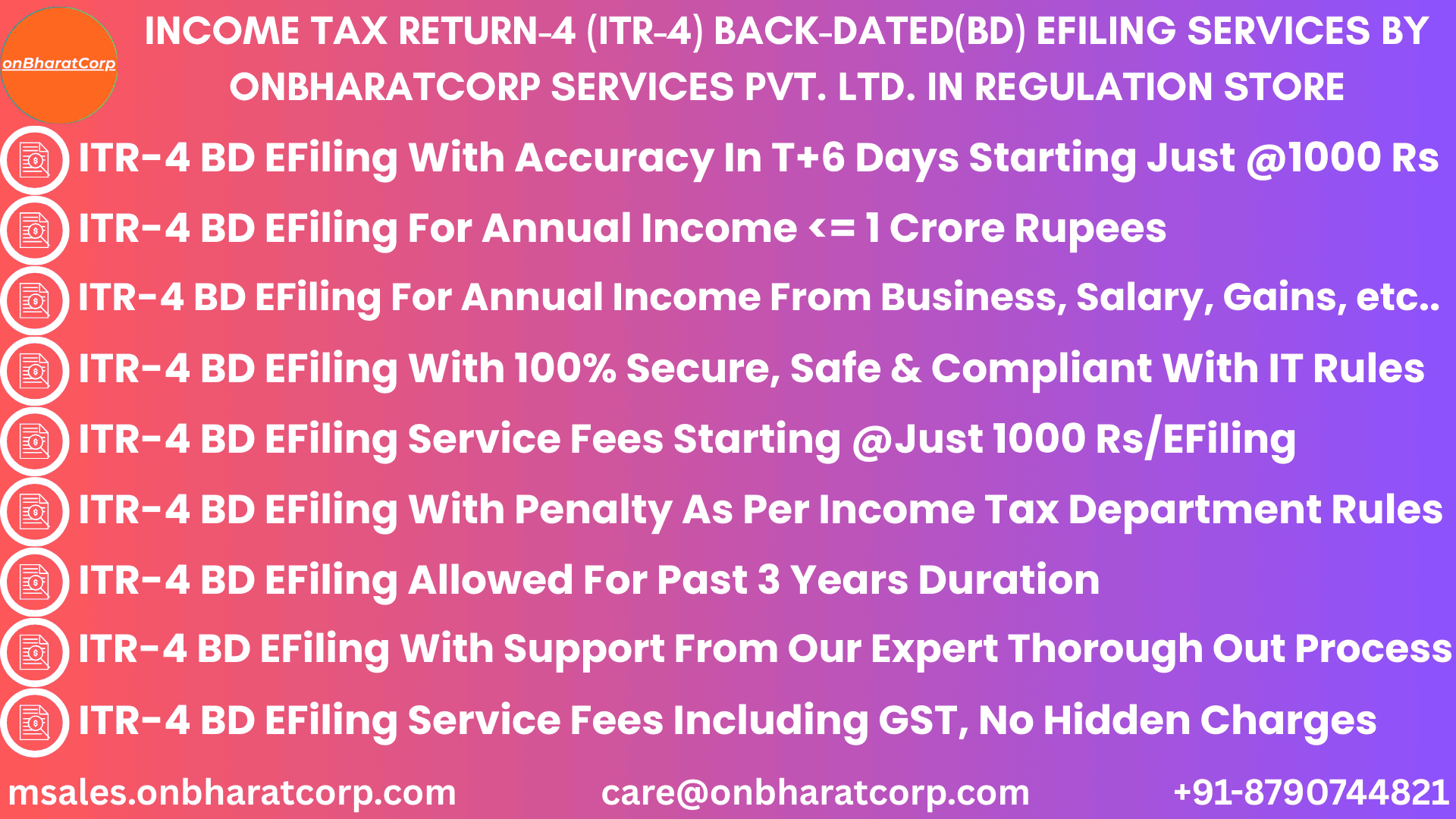

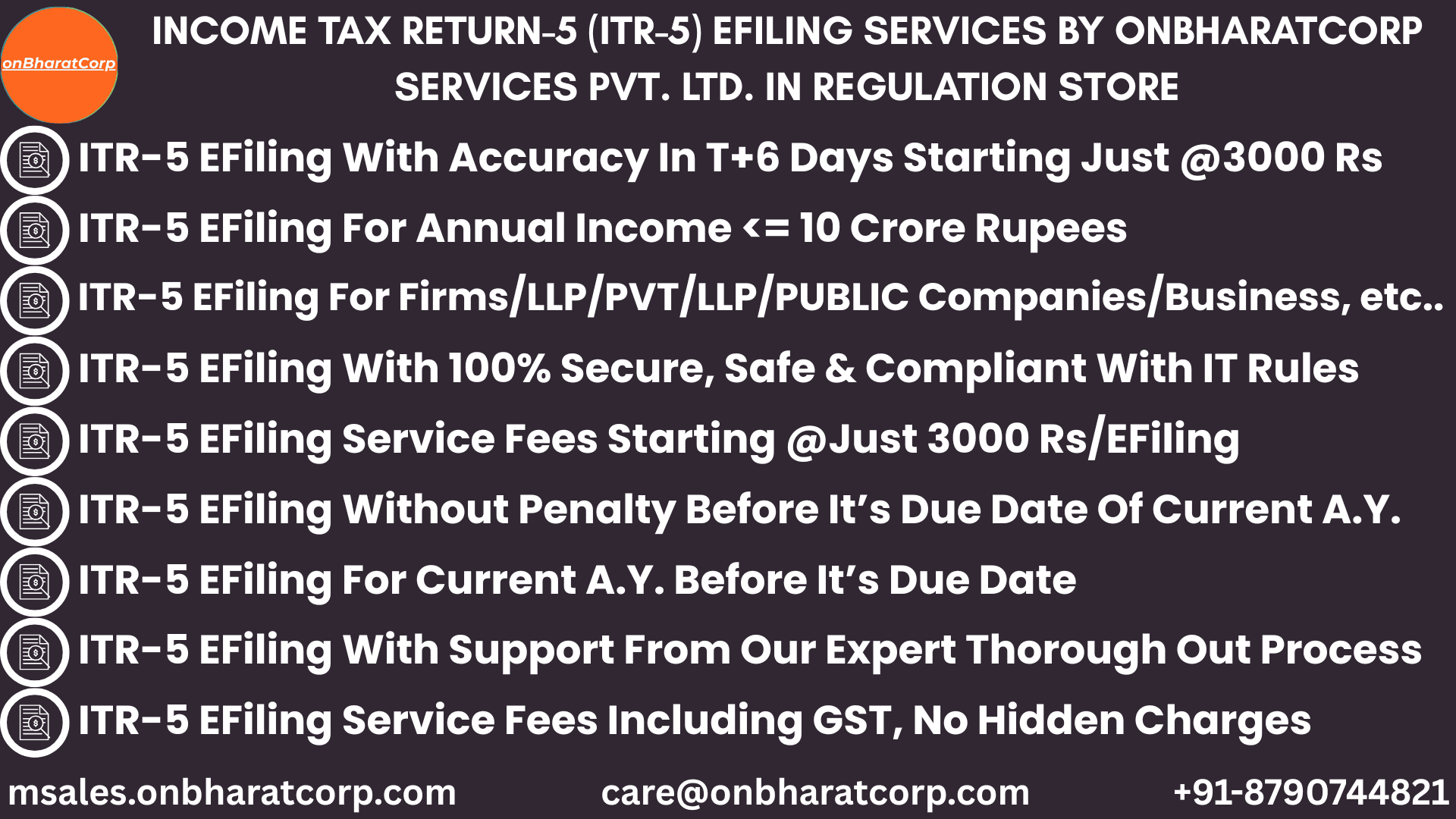

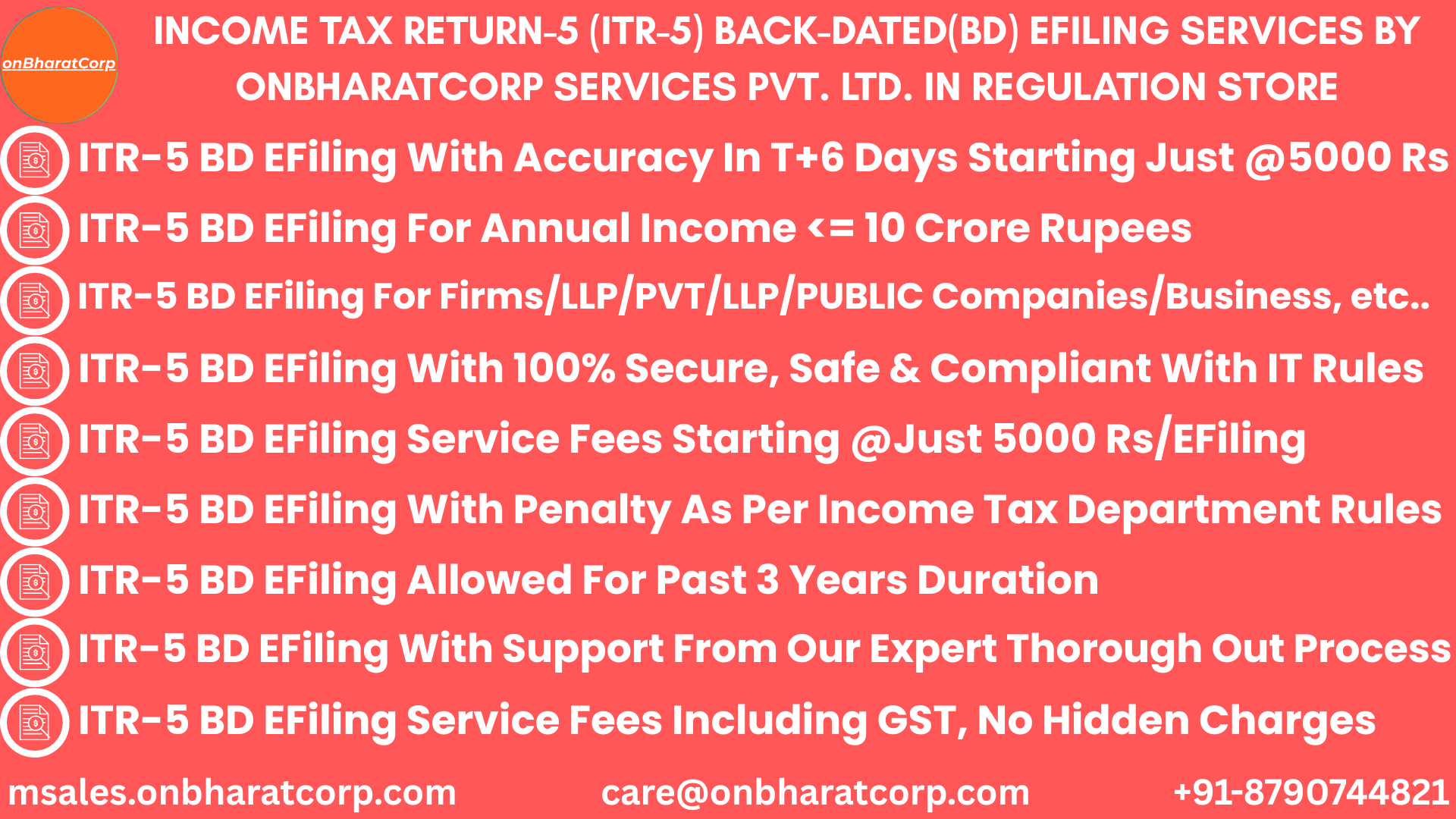

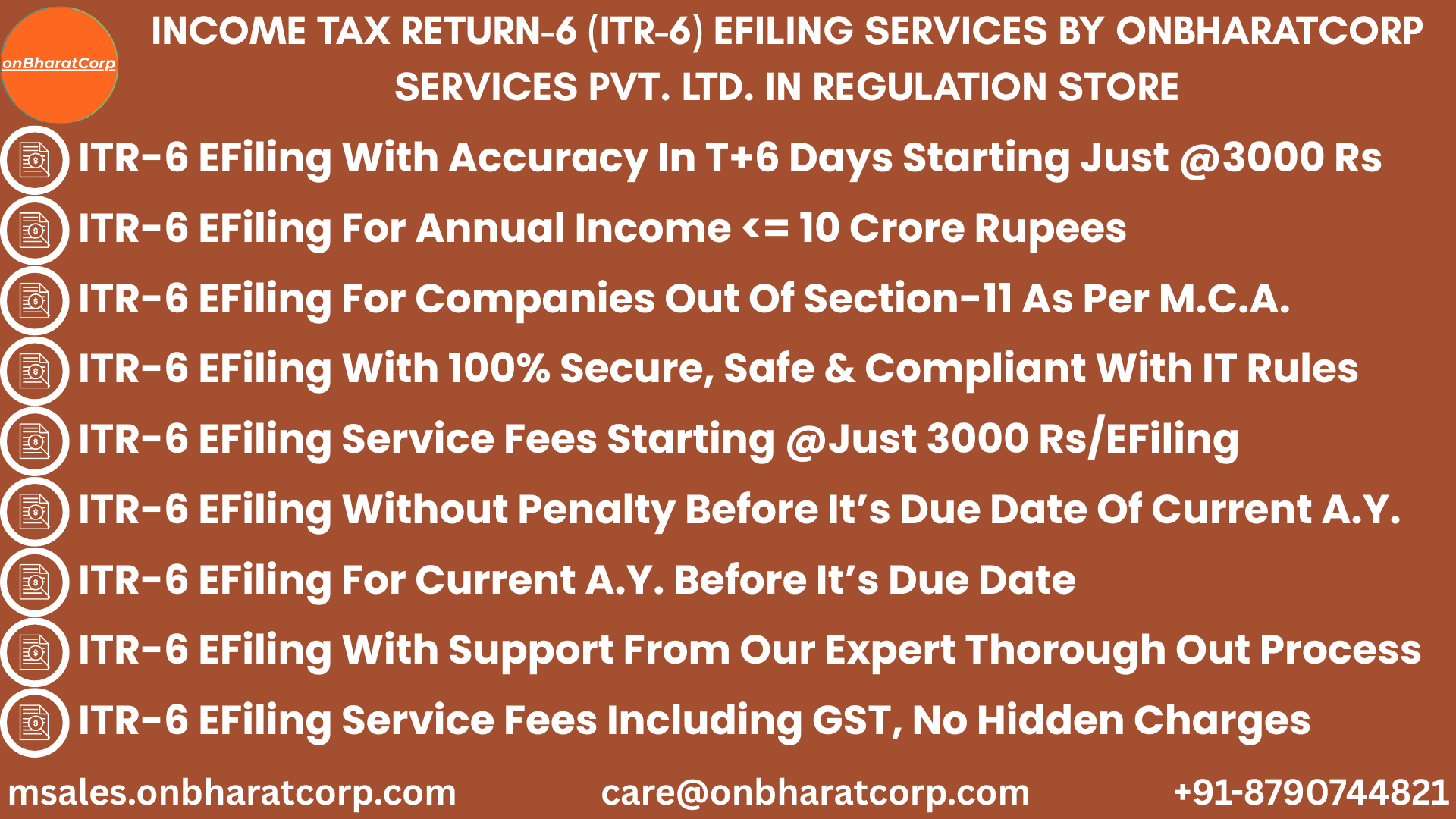

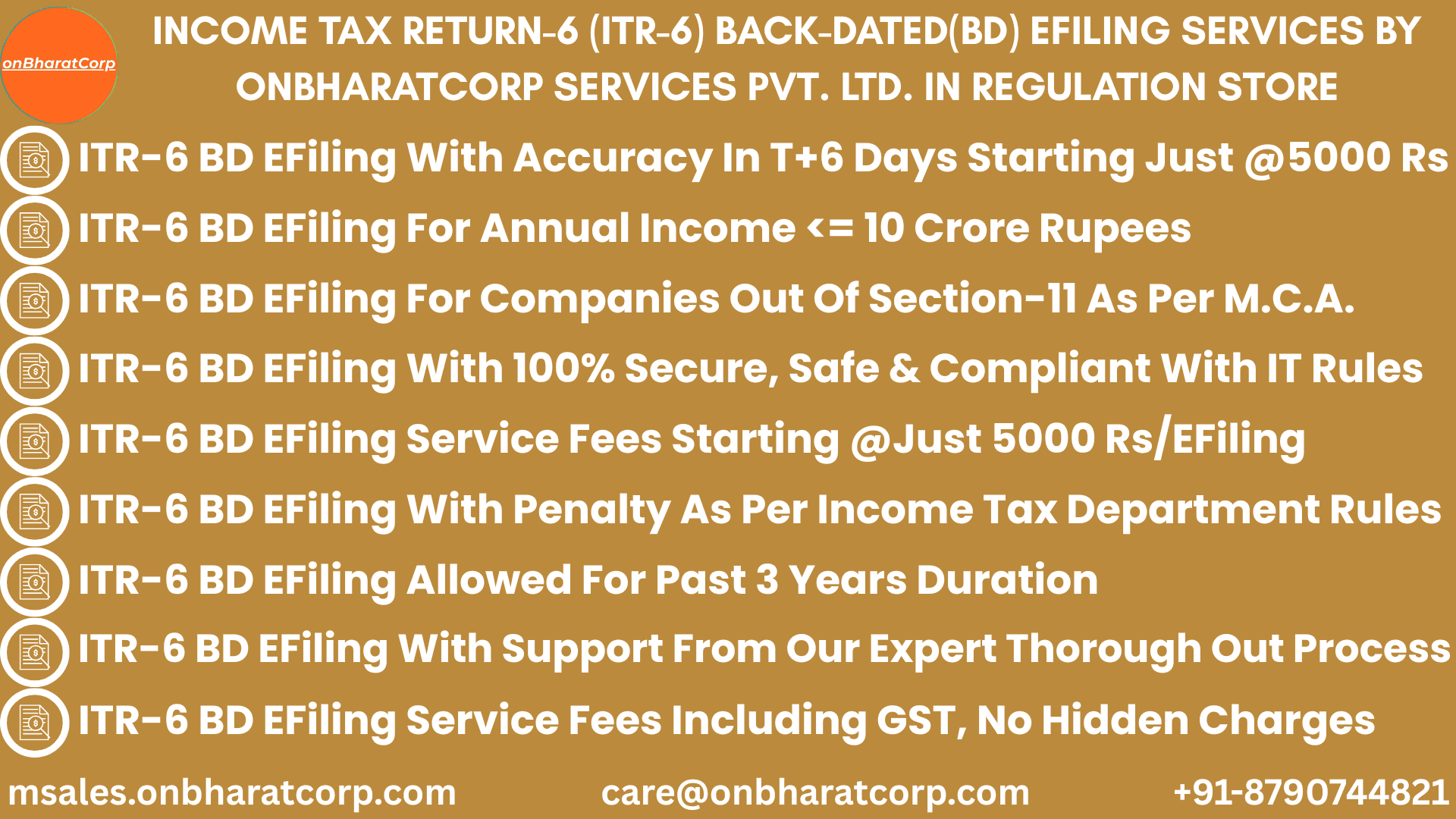

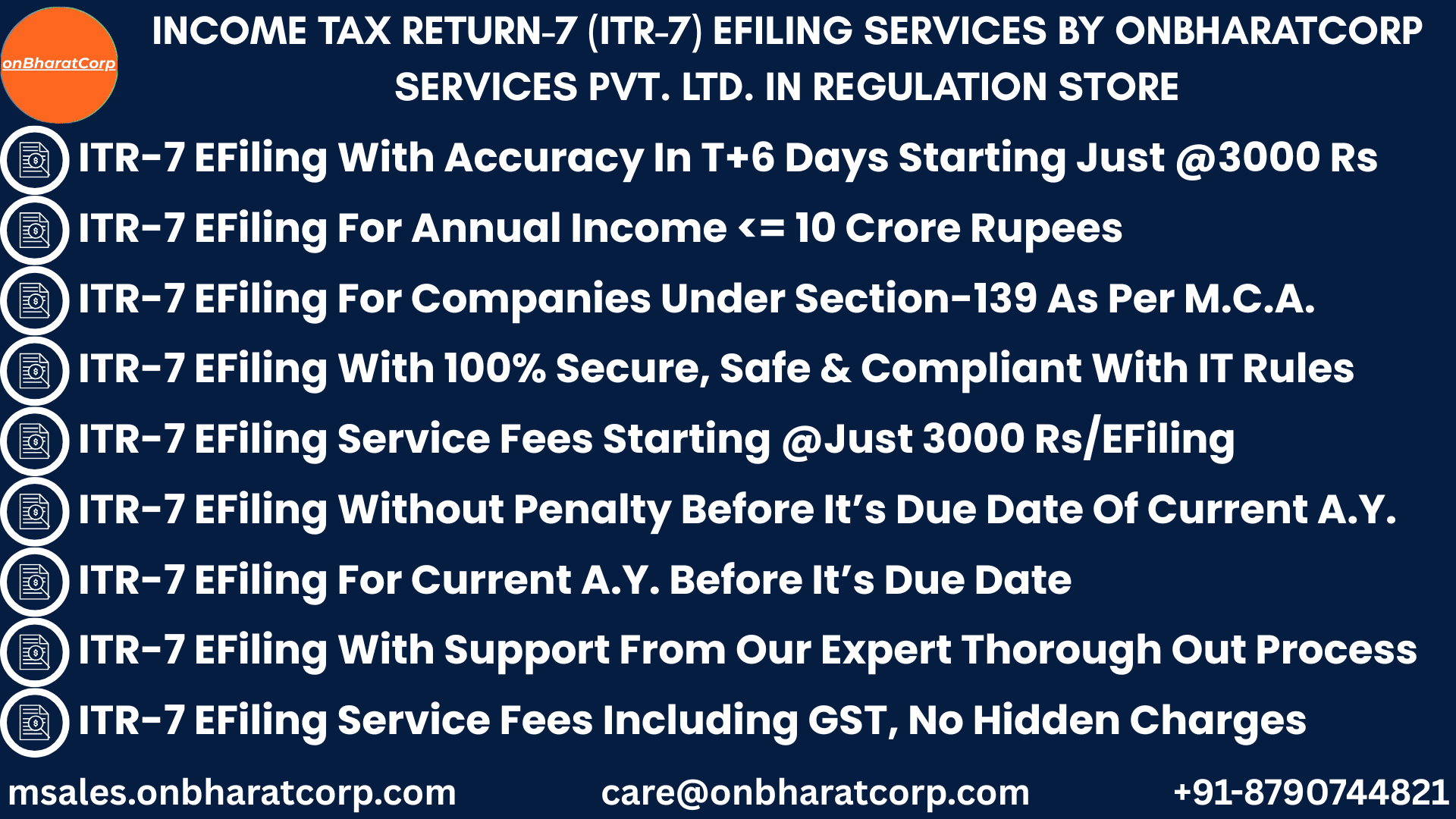

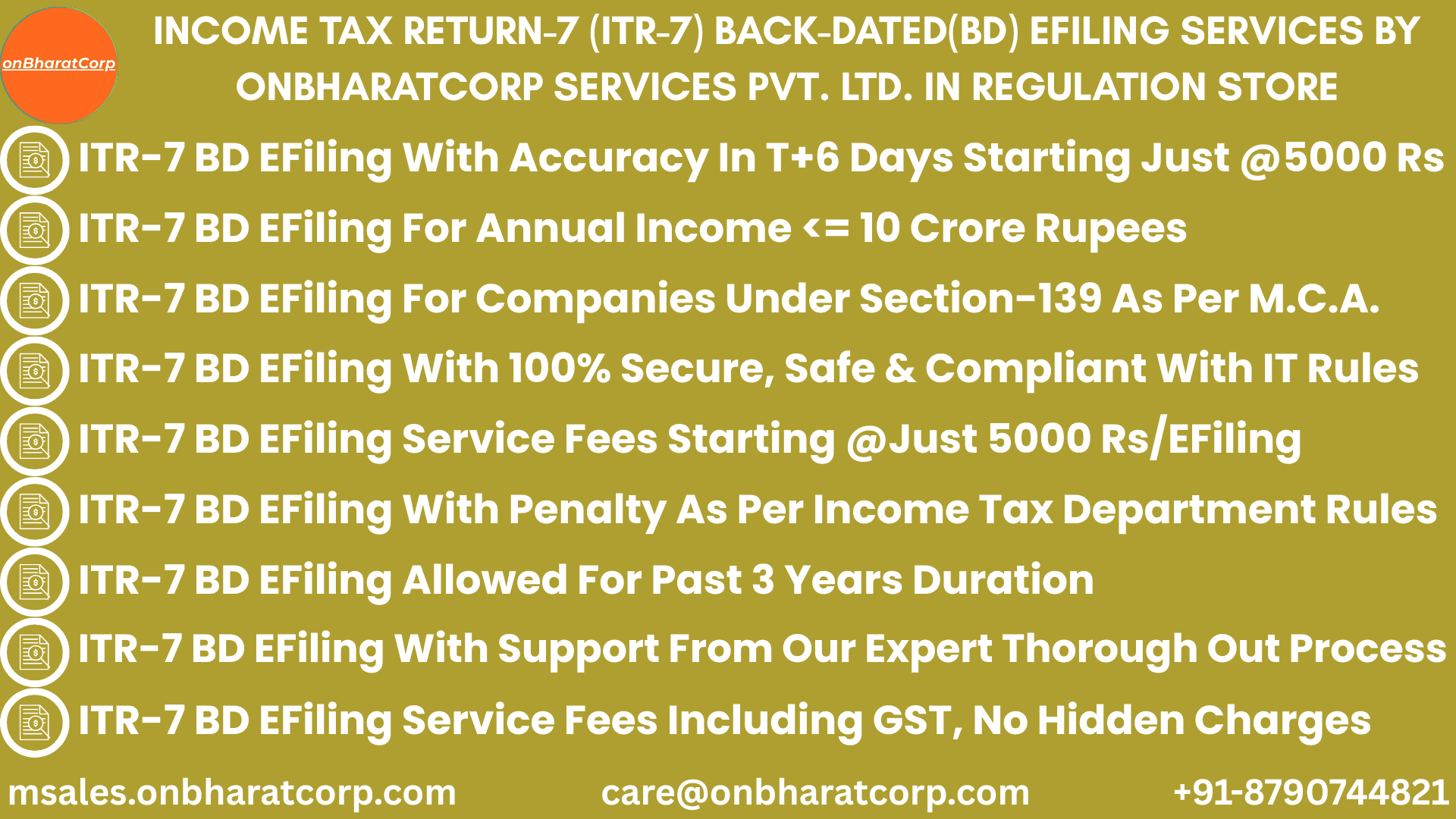

At onBharatCorp, we understand the critical importance of precise ITR filing and adherence to tax regulations. Our platform is designed to offer expert guidance and support in navigating the complexities of tax laws and filing procedures. We aim to empower taxpayers by equipping them with the necessary knowledge and resources, fostering their active participation in the tax-filing process to ensure compliance. By utilizing our expertise, taxpayers can confidently tackle the intricacies of tax legislation, leading to a successful ITR filing experience. Stay informed and compliant with the assistance of onBharatCorp.